Avoiding Common Pitfalls in Small Business Reorganization

- Melissa A. Youngman

- Nov 1, 2025

- 4 min read

Updated: Dec 12, 2025

By Winter Park Estate Plans & ReOrgs Admin

Florida Bankruptcy Attorney – Winter Park, FL

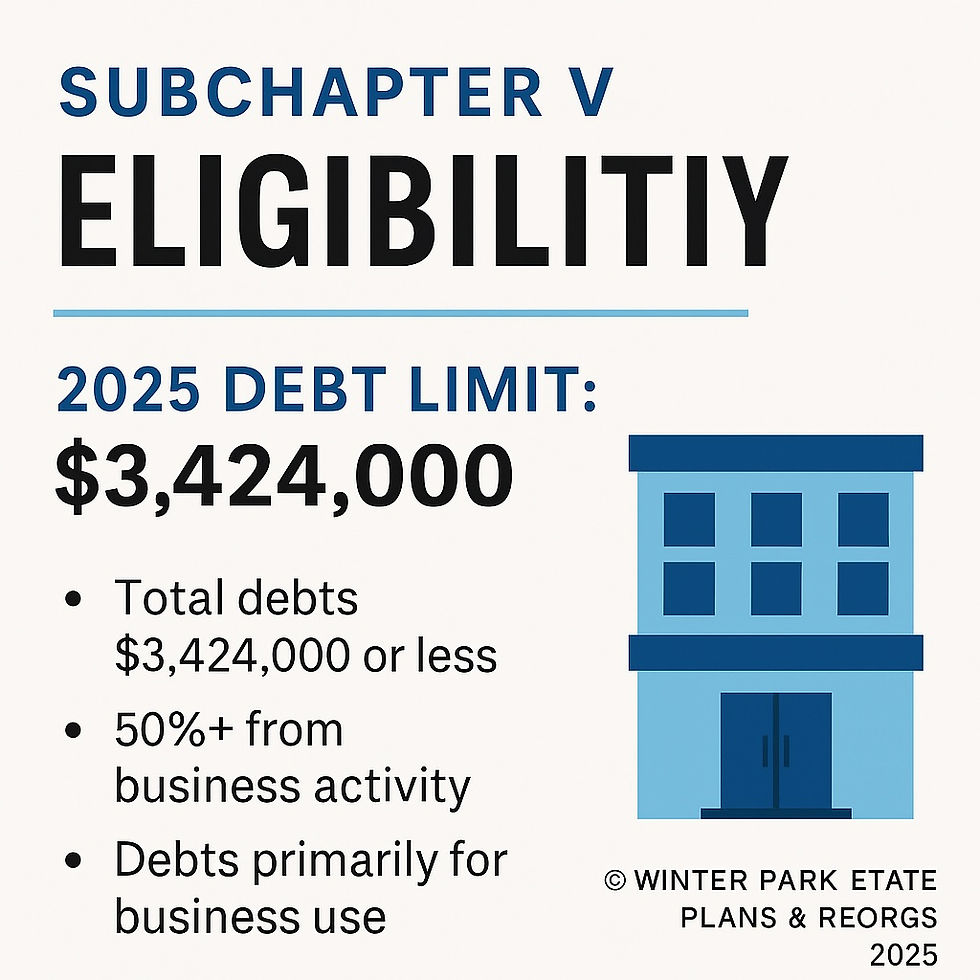

Filing for Chapter 11 or Subchapter V (which is a more streamlined version of Chapter 11 for small to midsize businesses) can be one of the smartest moves a struggling small business makes, but only if it’s done right. While bankruptcy reorganization offers a path to stability and renewal, many business owners run into preventable issues that delay or even derail their case.

In Florida, where small businesses form the backbone of local economies, understanding these challenges is critical to achieving lasting business recovery.

Here’s what to watch out for and how to avoid the most common pitfalls in small business reorganization cases.

1. Incomplete Financial Documentation

One of the first red flags for the U.S. Trustee or the court is missing or inconsistent financial information. Many debtors underestimate the level of transparency required when preparing schedules, statements of financial affairs, and supporting documents.

Without accurate records, your attorney can’t fully evaluate Chapter 11 feasibility or build a reliable reorganization plan.

Avoid this pitfall:

Gather three years of tax returns, current bank statements, loan documents, leases, and balance sheets.

Maintain an organized, month-by-month cash flow summary to demonstrate operational transparency.

Well documented financial disclosures builds credibility with the court and your creditors and keeps your case moving forward.

2. Overly Optimistic Projections

Courts, trustees, and creditors scrutinize projections closely when evaluating whether a reorganization plan is feasible. Overly optimistic revenue forecasts or understated expenses can undermine your case.

Chapter 11 feasibility hinges on showing that your business has a realistic chance of meeting the obligations outlined in the plan.

Avoid this pitfall:

Base your financial forecasts on conservative, data-driven assumptions.

Back up projections with historical performance and industry trends.

Include contingency plans for slow sales or unexpected expenses.

Credibility and realism are far more persuasive than wishful thinking.

3. Neglecting Post-Petition Operations

Filing for bankruptcy doesn’t pause day-to-day business responsibilities. During the reorganization, you’re still required to maintain insurance, pay taxes, file monthly operating reports, and stay current on payroll.

Neglecting these obligations is a common and serious mistake that could result in dismissal or conversion of your case, or appointment of a Chapter 11 trustee.

Avoid this pitfall:

Treat post-petition operations as your top priority.

Work with your accountant to ensure tax compliance and regular reporting.

Communicate proactively with your attorney so she can communicate proactively with your business's creditors, the Subchapter V trustee and opposing attorneys about any unexpected financial challenges.

Failure to follow through on operational requirements can result in case dismissal wiping out months of progress.

4. Poor Communication with Creditors

Reorganization is as much about negotiation as it is about numbers. Many small business owners try to avoid creditor interaction out of discomfort or fear. However, open and honest communication often makes the process smoother.

Avoid this pitfall:

Keep your attorney informed so she can provide creditors and the Court with timely updates and realistic repayment terms.

Avoid surprises. Transparency builds trust and fosters cooperation.

Remember that to confirm a plan, the court must find that the plan is “fair and equitable” to creditors. Creditors are more likely to support a plan in which they are treated fairly.

By giving your attorney all the information needed so that she can engage with creditors early and often, you create an environment where your plan can succeed rather than face objections.

5. Ignoring Professional Guidance

Perhaps the most preventable pitfall of all is failing to seek experienced legal and financial advice. DIY bankruptcy filings or inexperienced counsel can lead to missed deadlines, flawed filings, or infeasible plans. In fact, in Florida, incorporated businesses and LLCs must be represented by an attorney to proceed in bankruptcy court.

Avoid this pitfall:

Choose a law firm experienced in Florida business recovery, restructuring, reorganization, Subchapter V and Chapter 11, depending on your business's needs

Communicate openly with your attorneyso that she can craft a plan that fits your industry and cash flow realities.

An experienced reorganization team can help you stay compliant, meet deadlines, and maximize your chance of confirmation (the Court's plan approval process).

The Bottom Line

A reorganization plan can transform a struggling company into a viable one, but success requires discipline, transparency, and preparation. By avoiding these common pitfalls, Florida business owners can move through bankruptcy efficiently and set the stage for long-term recovery.

At Winter Park Estate Plans & ReOrgs, we help small businesses across Florida restructure debt, negotiate with creditors, and confirm feasible Chapter 11 plans that lead to sustainable growth.

📥 Download Our Chapter 11 Readiness Checklist

Get organized before you file and avoid common pitfalls. Download the Chapter 11 Readiness Checklist (PDF).

To schedule a free online/phone consultation with Melissa A. Youngman, our experienced Chapter 11 and Subchapter V attorney, call 📞 (407) 765-3427 or use the "Book Now" button below.

Read our comprehensive Guide to Florida Chapter 11 and Subchapter V Bankruptcy.

Comments