Creating a Feasible Reorganization Plan

- Melissa A. Youngman

- Oct 31

- 3 min read

By Winter Park Estate Plans & ReOrgs Admin

Florida Bankruptcy Attorney – Winter Park, FL

When a business files under Chapter 11 or Subchapter V, the reorganization plan becomes the heart of the case. It’s more than paperwork — it’s a roadmap for recovery.

Courts, creditors, and the U.S. Trustee all judge your case based on whether your reorganization plan is feasible, fair and equitable, and supported by credible financial evidence. In short, this document determines whether your business gets a second chance or faces liquidation.

Here’s what business owners need to know about creating a plan that works.

1. What “Feasibility” Means in Chapter 11/Subchapter V

Every plan must satisfy the Chapter 11 feasibility requirement, meaning it must show that your business can realistically meet its financial obligations under the proposed plan.

In practical terms, feasibility is your business’s ability to:

Generate enough income to pay ongoing expenses and fund plan payments,

Maintain adequate cash flow for operations, and

Avoid future defaults once the case concludes

Courts will look closely at your projections, budget assumptions, and historical financial data. If your projections are overly optimistic or unsupported, your plan may be denied.

That’s why most Florida bankruptcy practitioners work closely with your business to develop realistic, data-backed projections.

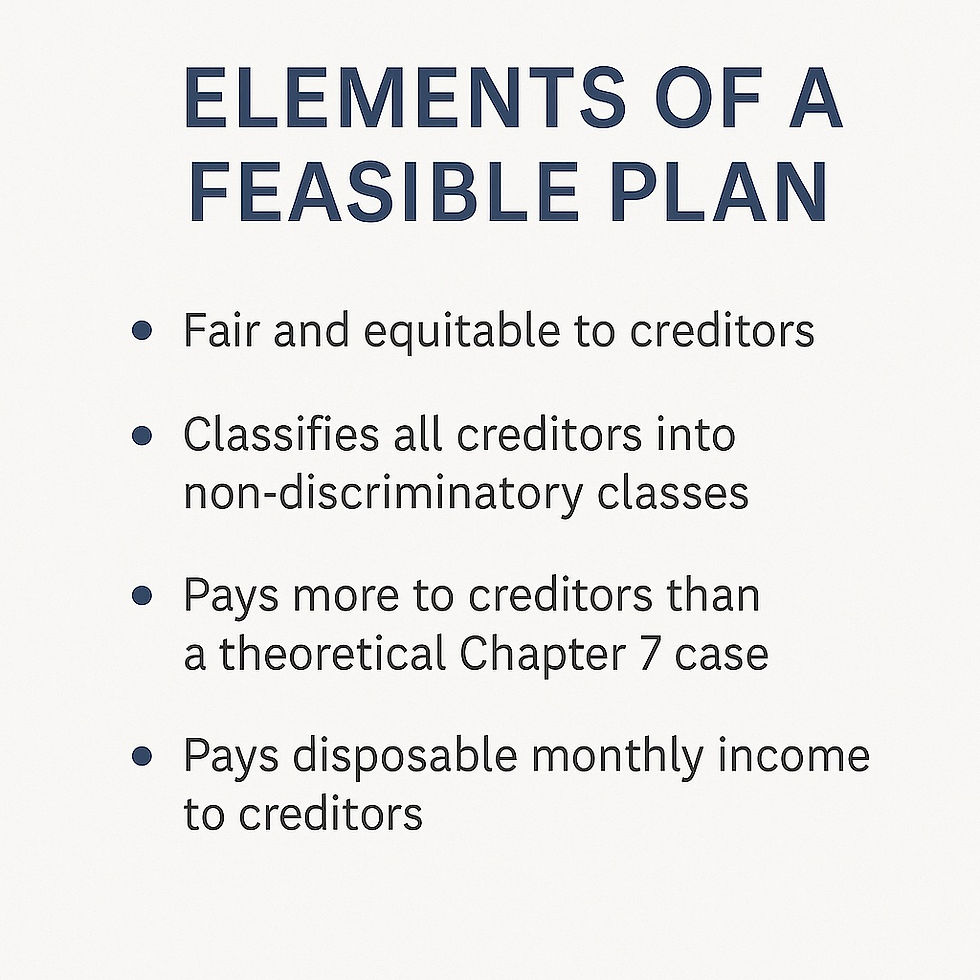

2. The “Fair and Equitable” Standard

To confirm a plan — especially if creditors object — the bankruptcy court must find that it is fair and equitable.

This standard ensures that Creditors receive at least what they would in a hypothetical Chapter 7 liquidation. In a traditional Chapter 11, Owners can’t retain equity under the plan unless they contribute new value or meet certain statutory requirements under the Absolute Priority Rule. However, the Absolute Priority Rule does not apply in Subchapter V cases. Instead, the Subchapter V debtor must show that the debtor's disposable monthly income will be used to pay the plan payments for the life of the plan.

3. The Role of Liquidation Analysis

Every reorganization plan must include a liquidation analysis, which is a financial comparison showing how much creditors would receive if the business were liquidated under a hypothetical Chapter 7 versus how much they will receive under the proposed plan.

This analysis helps demonstrate that your plan offers creditors a better recovery than immediate liquidation.

Your attorney will typically prepare a summary table showing:

The estimated liquidation value as of the petition date of assets (after secured claims and administrative costs),

Projected distributions under Chapter 7, and

Proposed payments under your Chapter 11 plan.

This step is essential to proving that your plan meets the best interest of creditors test, another key element of confirmation.

4. Building a Plan That Works

A strong reorganization plan should be specific, transparent, and achievable. Common components include:

Payment schedules for secured and unsecured creditors

Treatment of tax claims and priority debts

Retention or rejection of executory leases and contracts

Cash Flow projections showing plan feasibility

The plan should tell a convincing story of how your business will survive, and thrive, after bankruptcy.

For Florida businesses, that might mean restructuring lease obligations, renegotiating with vendors, or reducing overhead to align with realistic post-bankruptcy operations.

5. Subchapter V: A Streamlined Path to Feasibility

For smaller to midsize companies, Subchapter V simplifies the process by allowing plan confirmation, even without a minimum number of creditor votes in favor of the plan, and eliminating the need for a disclosure statement. The debtor retains control and files the plan exclusively, but the Bankruptcy Court still reviews feasibility and fairness.

This streamlined process can help business owners reach confirmation faster, provided their plan is feasibile and fair and equitable as required by the Bankruptcy Code.

The Bottom Line

A successful Chapter 11 case depends on a reorganization plan that’s realistic, supported by evidence, and compliant with the applicable provisions of the Bankruptcy Code. Winter Park Estate Plans & ReOrgs can make sure your Chapter 11 Plan is feasible, based on solid liquidation analysis and projections, and is fair and equitable to creditors. Florida business owners can emerge from bankruptcy with a stronger, more sustainable business model by hiring the right experienced bankruptcy attorney.

At Winter Park Estate Plans & ReOrgs, we guide clients through every stage of plan development, from financial analysis to court confirmation, to help their business restructure successfully with confidence.

📥 Download Our Chapter 11 Readiness Checklist

Get the documents you’ll need to prepare your reorganization plan. Download the Checklist (PDF).

To schedule a free online/phone consultation, call us at 📞 (407) 765-3427, or use the "Book Now" button below.

Comments