Essential Insights for Florida Business Owners on Filing Chapter 11 or Subchapter V Bankruptcy

- Melissa A. Youngman

- Oct 21, 2025

- 6 min read

Updated: Dec 12, 2025

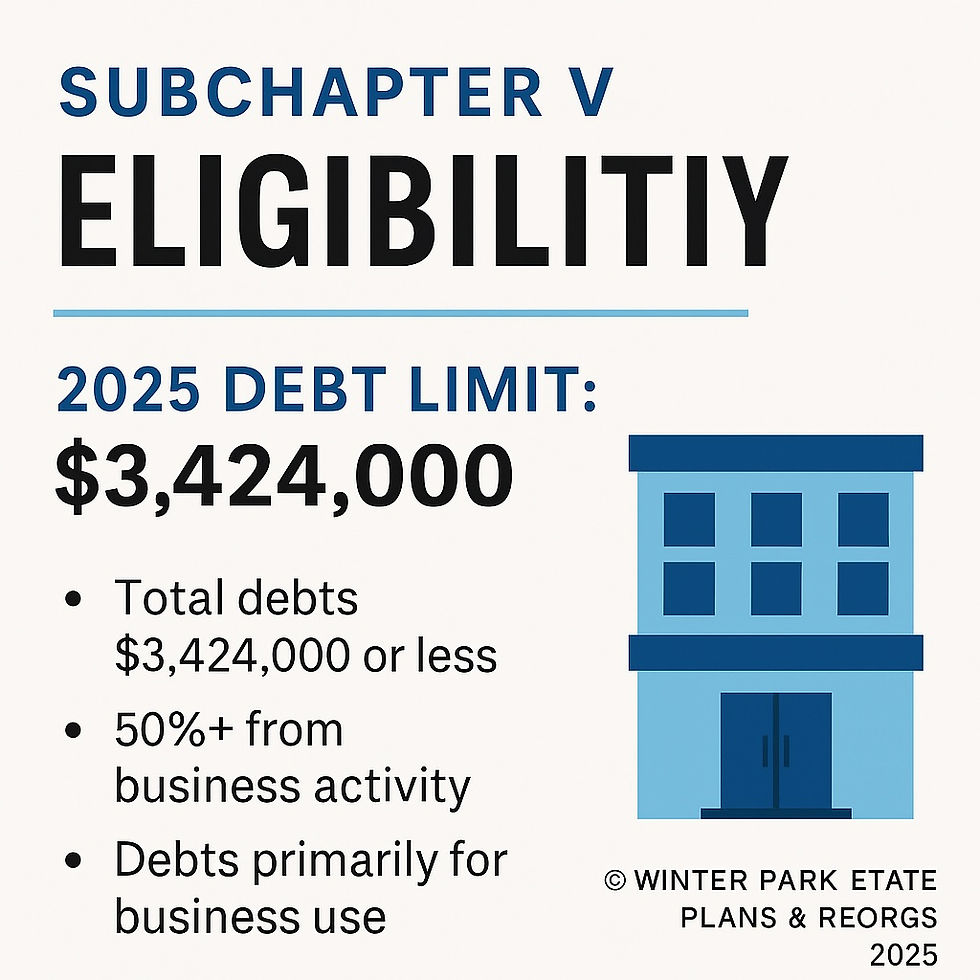

Facing financial troubles can feel overwhelming for business owners. Chapter 11 or Subchapter V (a streamlined version of Chapter 11) bankruptcy may offer a path forward that allows a business to reorganize debt and keep operating. Before pursuing this path, it is essential to understand the Chapter 11 process, including its purpose, timeline, challenges, and the benefits of expert guidance from experienced Chapter 11 attorneys like our Chapter 11 attorney, Melissa Youngman. Experienced counsel can significantly impact the success of your business Chapter 11 or Subchapter V case.

In this post, we will cover what every business owner must know before filing for Chapter 11, equipping you with the insights needed to determine the next best step for your business to resolve and reorganize its debt.

Understanding the Goals of Chapter 11: Reorganization vs. Liquidation

Chapter 11 bankruptcy primarily aims to help businesses reorganize their debts while continuing operations. The focus is not on shutting down but rather on restructuring to create a viable debt repayment plan over time.

Reorganization

Reorganization allows a business to restructure its debts and create a repayment plan that based on a budget, fairness to creditors, and the statutory requirements of the Bankruptcy Code. For example, a restaurant facing financial difficulties might consider filing Chapter 11 or Subchapter V to renegotiate its lease terms with its landlord, resulting in lower monthly rent and repayment of arrears. Companies can also cut operational costs by streamlining processes or reducing staff. Our experienced bankruptcy attorney, Melissa Youngman, will help your business assess its current operations to come up with a budget and plan to reorganize effectively. According to data from the U.S. Courts, around sixty percent (60% ) of Chapter 11 cases successfully emerge from bankruptcy and achieve positive operating results post-reorganization.

Liquidation

Although Chapter 11 and Subchapter V are primarily used to reorganize debt, if a business cannot develop a feasible plan based on restructuring its debt, it may seek approval of a liquidating plan to sell some or all of its assets through the Chapter 11 or Subchapter V process. For instance, if a manufacturing business can’t recover and opts for liquidation, it might sell its equipment and inventory, resulting in a complete shutdown. Doing so through a Chapter 11 or Subchapter V case may provide the business with breathing room from secured creditors to negotiate the best sale price and ensure that creditors are treated fairly through the Chapter 11 or Subchapter V sale process.

If, at the outset, liquidation is a priority rather than reorganization, a Chapter 7 bankruptcy, which focuses on liquidation—selling off assets to pay creditors through a Chapter 7 trustee may be an option in limited circumstances. There are many considerations a business owner would need to discuss with experienced bankruptcy counsel before determining whether to file bankruptcy and what chapter to file under. Understanding these outcomes is crucial for business owners, as it impacts the future of their companies.

Key Steps in the Chapter 11 Process

Filing for Chapter 11 consists of several pivotal steps that business owners should thoroughly understand.

Filing for Chapter 11

The process starts with filing a petition in bankruptcy court. This petition must include comprehensive financial details and disclosures, such as assets, liabilities, income, and expenses. Meticulous documentation is vital; inaccuracies can complicate your case or even lead to dismissal or conversion to a Chapter 7 liquidation.

Automatic Stay

When the petition is filed, an automatic stay is imposed, which requires all creditors to cease collection communications and activities against the business, including lawsuits, allowing the business to focus on reorganizing while the case is pending. The automatic stay is often a critical tool, enabling businesses to operate without the constant pressure of creditor calls, letters, and litigation.

Debtor-in-Possession

During the Chapter 11 process, the business usually continues as a debtor-in-possession, meaning existing management retains control of the business so long as the business meets its obligations under the relevant statutes of the Bankruptcy Code and Court rules and procedures . For example, a clothing retailer in Chapter 11 would maintain its daily operations while following the specific reporting requirements of the Bankruptcy Code, the Office of the U.S. Trustee, and seeking court approval for major decisions such as accepting and rejecting leases and other executory contracts. Businesses in chapter 11 or Subchapter V generally continue to operate their businesses using their own business judgement so long as they also comply with the requirements of the Bankruptcy Code, the Court, and the requirements of the Office of the U.S. Trustee.

Typical Timeline and Cost Overview

Timeline

Subchapter V cases generally require the filing of a plan no later than 90 days after the filing of the case, with one three month extension allowed in limited circumstances. Accordingly, the pre-confirmation process generally takes three to six months. If the confirmed (i.e. Court approved) plan is a reorganization plan, the payment term will typically be three to five years.

For traditional Chapter 11 cases, the timeline is longer and depends on the circumstances of each case. It is not unusual for the case to last a year or longer. Once the reorganization plan is confirmed (i.e. approved by the Court), the plan term varies. It may be five years, ten years, or even 15 years, depending on what the Court deems to be reasonable within the circumstances of the case.

Cost Overview

The costs associated with Chapter 11 can be substantial. On average, small to mid0size Florida businesses may incur legal fees and administrative expenses ranging from $25,000 to over $100,000, depending on which Chapter is filed and how much creditor resistance is encountered in the case. Bankruptcy attorneys typically require a retainer up front for a portion of these fees to be billed against while the case is pending. It is crucial to prepare a budget that reflects these costs and their effects on your business’s financial health during and after the reorganization. Our experienced Chapter 11 attorney, Melissa Youngman, will help your business create a budget and projections for your case that allows for the payment of attorney's fees and a path forward through the Chapter 11 or Subchapter V process.

Common Mistakes That Cost Debtors Early Momentum

While Chapter 11 offers a chance for recovery, several common mistakes can derail the case resulting in dismissal or conversion to a Chapter 7 liquidation.

Lack of Preparation

One of the most significant errors is inadequate preparation before filing. Understanding your financial situation and having necessary documentation ready can set the foundation for success. For instance, failing to gather critical financial statements can lead to delays or even case dismissal or conversion. To download a list of documents and evaluate whether your business is ready to file a Subchapter V or Chapter 11 case, download our free "Chapter 11 Readiness" Checklist using the button below.

Ignoring Creditor Relationships

Neglecting relationships with creditors can be detrimental. Maintaining open communication can foster goodwill, which might facilitate negotiations that are more favorable for your reorganization.

Delaying Action

Procrastination can exacerbate problems. Delaying a Chapter 11 filing may lead to increased debts and complications. A business facing mounting bills should act quickly; statistics show that businesses that file sooner tend to have more successful outcomes.

Underestimating Costs

Many owners underestimate the financial burden of Chapter 11. It is vital to create a realistic budget that includes anticipated and unexpected expenses to maintain financial stability throughout the process. Our firm will help you create realistic budget and projections to help you obtain the best outcome in your Chapter 11 or Subchapter V case.

The Importance of Professional Guidance Early in the Process

Navigating Chapter 11 is complex, and obtaining professional guidance early can be invaluable.

Expertise in Bankruptcy Law

Bankruptcy attorneys provide specialized legal knowledge that can help business owners understand their rights. They guide you through the filing process, ensuring accurate documentation and compliance with laws. Our Chapter 11 attorney, Melissa Youngman, has more than 22 years of experience representing debtors in all types of bankruptcy cases including Chapter 11 and Subchapter V.

Strategic Planning

Professionals help craft a comprehensive reorganization plan tailored to your business’s specific challenges. This planning is critical for winning creditor approval and executing the strategy effectively.

Avoiding Mistakes

An experienced bankruptcy professional can highlight common pitfalls and offer best practice insights to help you avoid missteps that could hinder your timeline.

Emotional Support

Filing for Chapter 11 is emotionally taxing. Having an expert guiding you through the process can alleviate stress, allowing you to focus on the business's future. Your bankruptcy attorney will do the heavy lifting on the legal side while you focus on what you do best - your business.

Moving Forward in the Right Direction

Filing for Chapter 11 can be overwhelming for business owners, but knowledge can empower you to navigate this path effectively. Understanding the goals, key steps, costs, mistakes to avoid, and the significance of expert guidance will help you create a solid plan for recovery.

By approaching Chapter 11 and Subchapter V with clarity and support, you can work toward a successful reorganization and steer your business back to success. With determination and the right bankruptcy counsel, a financial fresh start for your business is entirely possible. Take time to educate yourself and consult with professionals who can help you make informed decisions about your business’s future.

Read our comprehensive Guide to Florida Chapter 11 and Subchapter V Bankruptcy.

Comments