Selecting the Right Chapter 11 Strategy for Your Business

- Melissa A. Youngman

- Oct 29, 2025

- 4 min read

Updated: Dec 12, 2025

By Winter Park Estate Plans & ReOrgs Admin

Florida Bankruptcy Attorney – Winter Park, FL

When financial pressure mounts, Chapter 11 bankruptcy can offer a solution to restructure debt while keeping the business doors open. It allows your business to reorganize debt, protect your assets, and keep operations running. But not all Chapter 11 cases are the same.

Choosing the right Chapter 11 strategy means understanding your business’s goals, debt situation, and available resources. For companies in Central Florida, including those pursuing Orlando business restructuring, the difference between a successful turnaround and a drawn-out case often comes down to preparation and planning.

1. Know Your Business Goals Before You File

Every Chapter 11 case starts with the same question: What is your business trying to achieve?

Some owners want to restructure secured loans and continue operating. Others may need time to sell assets or reorganize ownership. An experienced Chapter 11 attorney can help you determine these priorities before filing and ensure that the bankruptcy plan submitted to the court for approval will align with those goals while treating creditors fairly.

A clear plan of reorganization is more than a legal document; it’s a roadmap for survival.

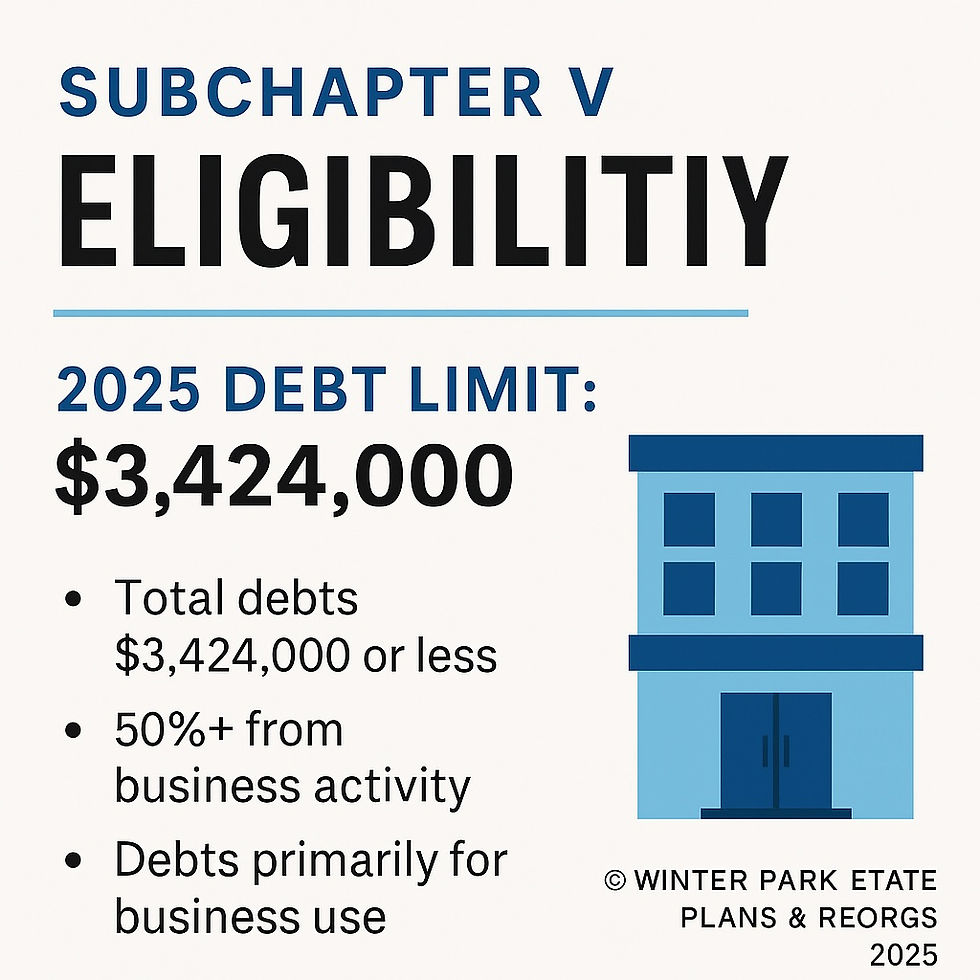

2. Determine Whether Subchapter V Fits Your Situation

For small to mid-sized businesses, the Subchapter V option under Chapter 11 offers faster timelines, lower costs, and greater control. However, it’s available only to debtors with less than $3,424,000 in total debt and whose debts are primarily commercial.

If you qualify, Subchapter V can simplify your reorganization paperwork and help you confirm a plan even if no creditors vote in favor of the plan. But if your business's debts exceed the debt limit or involve complex financing, a traditional Chapter 11 case might be a better fit.

An experienced Florida bankruptcy attorney, like our attorney, Melissa Youngman, can help you analyze your business's eligibility before you file — saving time, money, and stress later.

3. Prepare Complete and Accurate Financials

Incomplete filings are one of the most common causes of delay in Chapter 11 cases. Before your petition is filed, gather all required financial documentation, which typically includes:

Tax returns for the past three years

Profit and loss statements

Balance sheets

Bank account statements

Loan documents and leases

Lists of assets, liabilities, and creditors

This reorganization paperwork forms the foundation of your case, the bankruptcy petition and schedules. It’s also what the Office of the U.S. Trustee and creditors will review at the start of your bankruptcy, especially during the Initial Debtor Interview (an interview with an analyst at the Office of the U.S. Trustee that occurs within a week or two of case filing) and the Section 341 Meeting of Creditors (a formal interview conducted by an attorney for the Office of the U.S. Trustee where you will testify under oath on behalf of your business and creditors are invited to attend. This meeting typically occurs about 30 days after your case is filed.)

Missing or inaccurate records can result in additional scrutiny that slows your reorganization.

4. Be Realistic About Cash Flow and Operations

A Chapter 11 plan must be feasible, meaning we must convince the court that your company can make the payments it promises based on actual evidence. Unrealistic projections are one of the fastest ways to derail a case into dismissal or conversion to a Chapter 7 liquidation.

Before the case is filed, we will help you prepare a six-month operating budget based on the business's performance in the months leading up to filing, and cash flow projections based on that budget. The budget and projections will be used to demonstrate how your business will fund ongoing operations during reorganization.

5. Work Closely With Your Legal Team

Filing for Chapter 11 isn’t just about paperwork, it’s about strategy. Our experienced Orlando business restructuring attorney, Melissa Youngman, can help you:

Evaluate whether Chapter 11 or Subchapter V is right for your business

Anticipate creditor objections before they arise

Structure payments and plan terms that align with your revenue streams

Avoid common pitfalls in compliance and reporting

Remember: your attorney isn’t just preparing your petition; they’re positioning your company for long-term recovery.

The Bottom Line

Selecting the right Chapter 11 strategy requires more than checking boxes. It demands clarity, preparation, and the right professional guidance. By gathering the right information and documents ahead of time so that your attorney can draft your reorganization paperwork accurately and completely, your business can enter bankruptcy ready to rebuild, not just react.

At Winter Park Estate Plans & ReOrgs, we guide Florida business owners through every stage of Chapter 11, from document collection to plan confirmation, with a focus on cost efficiency and practical solutions.

📥 Download Our Chapter 11 Readiness Checklist

Find out what documents and strategies you’ll need before filing. Download the Checklist (PDF).

To schedule a free online/phone confidential consultation, call 📞 (407) 765-3427 or use the "book now" button below.

Read our comprehensive Guide to Florida Chapter 11 and Subchapter V Bankruptcy.

Comments