When a Creditor Pushes Your Business into Chapter 11

- Melissa A. Youngman

- Nov 13, 2025

- 4 min read

Updated: Dec 12, 2025

By Winter Park Estate Plans & ReOrgs Admin

Florida Bankruptcy Attorney – Winter Park, FL

For many small and mid-sized businesses, financial distress doesn’t happen overnight. It builds gradually - a slow tightening of credit, delayed payments, and growing creditor pressure that eventually becomes overwhelming.

When vendors, landlords, or lenders start demanding immediate payment, filing lawsuits, or threatening foreclosure, business owners often feel trapped between keeping operations running and facing financial collapse.

In some cases, it’s the creditors themselves who push a business into bankruptcy, either through collection actions or (more rarely) by filing what’s called an involuntary petition.

Understanding how and why this happens, and how Chapter 11 can help you regain control of your business, is critical for protecting your company’s future.

1. Understanding Creditor Pressure

Creditor pressure can take many forms:

Frequent collection calls or payment demands,

Lawsuits for unpaid invoices or loans,

Threats to seize collateral or freeze bank accounts,

Landlords attempting to evict for past-due rent, or

Vendors cutting off supplies or services.

For Florida businesses already operating with tight cash flow, even one aggressive creditor can cause a ripple effect that disrupts payroll, vendor relationships, and customer service.

When negotiations fail or creditors refuse to cooperate, Chapter 11 may be the best (and sometimes the only) option to stop the chaos and create breathing room.

2. The Role of the Automatic Stay

The moment a Chapter 11 bankruptcy petition is filed, the automatic stay takes effect.

This powerful legal tool immediately halts all collection actions, including:

Lawsuits and judgments,

Foreclosures and repossessions,

Wage or bank garnishments,

Contract terminations or evictions, and

Harassment from creditors or collection agencies.

For many business owners, the automatic stay is a lifeline, providing time and protection needed to assess financial options, stabilize operations, and begin restructuring debt through a court-approved plan. In short, it stops the bleeding so the business can heal.

3. Involuntary Chapter 11: When Creditors File for You

While most Chapter 11 cases are filed voluntarily by the business, creditors also have the power to initiate an involuntary bankruptcy if certain conditions are met.

Under federal law, creditors may file an involuntary Chapter 11 petition if:

The business owes more than $21,050.00 in unsecured, non-contingent debt, and

At least three creditors (or one, if there are fewer than 12 creditors total) join the petition.

Creditors typically take this step when they believe a debtor is hiding assets, favoring certain creditors over others, or simply failing to meet obligations.

Once filed, the debtor can contest the petition, but if the court approves it, the business will be placed under bankruptcy protection, with all the accompanying rules and procedures.

While it may sound drastic, even an involuntary case can become an opportunity for Florida debt negotiations and reorganization under court supervision.

4. How Chapter 11 Can Restore Control

Once a Chapter 11 case begins, whether voluntary or involuntary, the business owner (the “debtor in possession”) usually retains control of daily operations.

That means you can:

Continue managing employees, customers, and vendors,

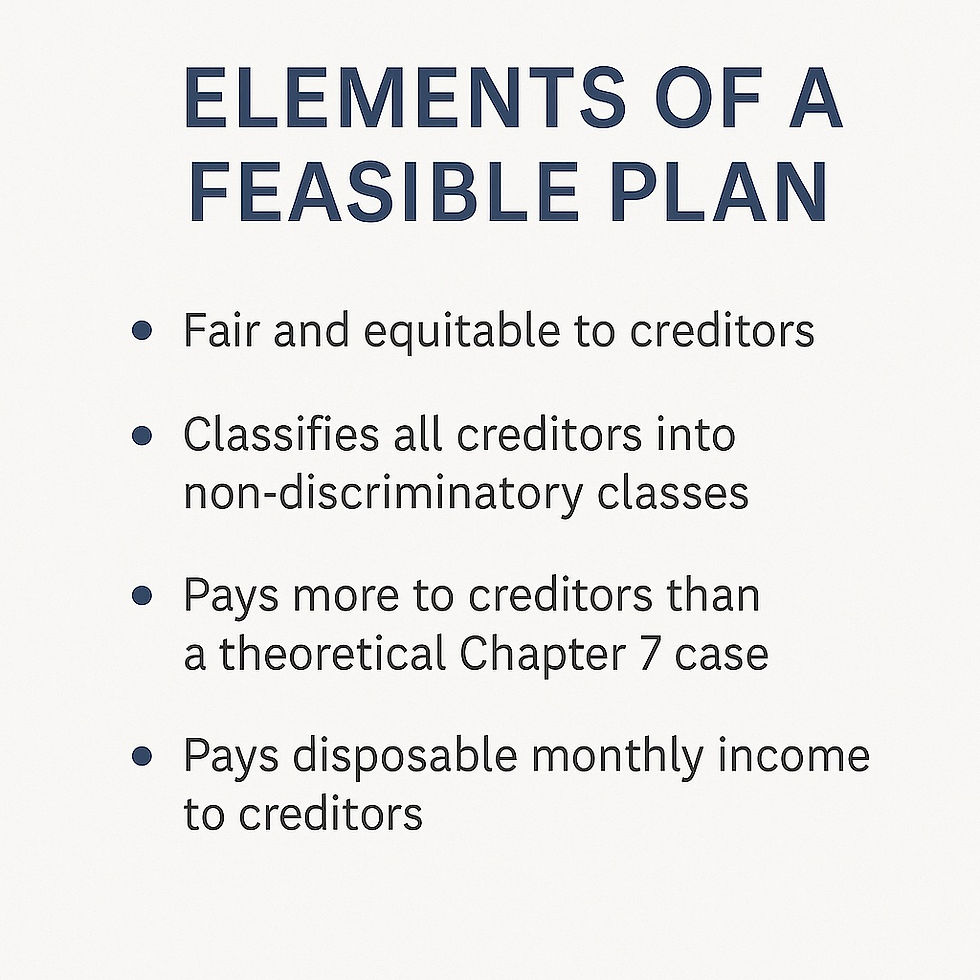

Propose a plan of reorganization to restructure debts, and

Negotiate new repayment terms with creditors.

With the help of experienced counsel, you can turn a defensive situation into a proactive one, using the process to renegotiate loans, reduce interest rates, and consolidate payment obligations into a sustainable structure.

In many cases, Chapter 11 transforms creditor pressure into productive dialogue through court-supervised Florida debt negotiations.

5. The Benefits of Subchapter V for Small Businesses

For smaller companies, the Subchapter V option within Chapter 11 simplifies the process and makes it more affordable.

Subchapter V offers:

Exclusive control over filing the reorganization plan,

No minimum number of creditors votes needed to confirm a plan, and

Streamlined reporting and confirmation procedures.

It’s specifically designed for small businesses that need a fresh start — not a drawn-out legal battle.

If your company’s debts total under $3,424,000, Subchapter V may be the fastest way to regain control, silence creditor threats, and emerge with a clean slate.

6. Turning Pressure into Opportunity

While creditor pressure can feel overwhelming, it often signals the right time to seek professional help and take decisive action. Bankruptcy doesn’t mean failure. In many cases, it’s a strategic tool used by savvy business owners that offers the business survival and recovery.

The key is to act before creditors act for you.

At Winter Park Estate Plans & ReOrgs, we help Florida business owners navigate financial distress, manage debt negotiations, and use Chapter 11 or Subchapter V to protect their business and its assets.

If your creditors are closing in, we can help you take back control — and turn a crisis into an opportunity for reorganization and renewal.

📥 Download Our Chapter 11 Readiness Checklist

Understand the steps to prepare for reorganization and debt protection. Download the Checklist (PDF)

To schedule a free online/phone consultation, call 📞 (407) 765-3427 or use the Book Now button below.

Read our comprehensive Guide to Florida Chapter 11 and Subchapter V Bankruptcy.

Comments