top of page

All posts

FAQs: Chapter 11 and Subchapter V

Chapter 11 is a federal bankruptcy restructuring process that allows a business to continue operating while reorganizing its debts. Subchapter V is a special streamlined version of Chapter 11 created specifically for small and medium businesses.

Melissa A. Youngman

Nov 21, 20254 min read

How Bankruptcy Can Preserve the Value of Your Business

When financial pressure builds, many owners of Florida small business operations assume bankruptcy means the end of the road. They imagine shuttered stores, liquidation sales, or losing everything they’ve worked for. But that assumption is almost always wrong. In reality, bankruptcy, especially Chapter 11 and Subchapter V, can actually preserve the value of your business, protect employees, strengthen vendor relationships, and position your company for long-term success.

Melissa A. Youngman

Nov 20, 20254 min read

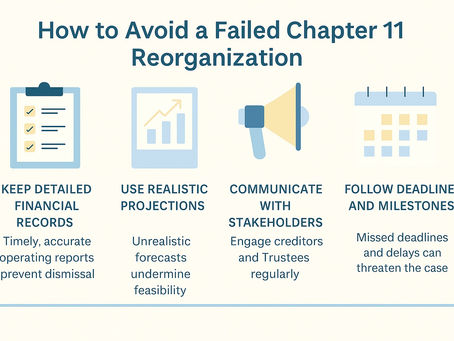

Chapter 11 & Subchapter V: Dismissals, Conversions, and Avoiding a Failed Reorg

By Winter Park Estate Plans & ReOrgs Admin Florida Bankruptcy Attorney – Winter Park, FL Business owners often enter Chapter 11 with one clear goal: to stabilize operations and achieve a successful business reorganization . But between filing day and confirmation, the path can become complicated. Cash flow issues, missed deadlines, or unresolved disputes can derail even a well-planned case. When a reorganization begins to falter, the court may consider dismissal or conversi

Melissa A. Youngman

Nov 19, 20254 min read

Post-Confirmation Challenges: What Businesses Should Expect After Reorganization

For Florida entrepreneurs navigating a Florida business bankruptcy, post-confirmation responsibilities can still be substantial. Whether your case proceeded under traditional Chapter 11 or its streamlined counterpart, Subchapter V confirmation marks the beginning of your obligations under the confirmed plan, not the end.

Melissa A. Youngman

Nov 18, 20254 min read

Litigation Threats During Reorganization: What Business Owners Need to Know

For business owners already juggling reorganization, additional bankruptcy litigation can feel overwhelming, but with the right strategy and legal support, bankruptcy litigation can be managed and even turned to your advantage.

Melissa A. Youngman

Nov 17, 20254 min read

The Chapter 11 Confirmation Process: Plan & Disclosure Statement, Solicitation, Creditor Voting and the Absolute Priority Rule

For businesses reorganizing under Chapter 11, plan confirmation is the finish line. At confirmation, the court decides whether the business's proposed repayment plan is approved so that the company can move forward.

Melissa A. Youngman

Nov 14, 20254 min read

When a Creditor Pushes Your Business into Chapter 11

When vendors, landlords, or lenders start demanding immediate payment, filing lawsuits, or threatening foreclosure, business owners often feel trapped between keeping operations running and facing financial collapse. Understanding how and why this happens, and how Chapter 11 can help you regain control of your business, is critical for protecting your company’s future.

Melissa A. Youngman

Nov 13, 20254 min read

Emerging Trends in Subchapter V in Florida

When Congress enacted the Small Business Reorganization Act of 2019, it had one goal in mind, to give small business owners a fair, affordable, and efficient path to reorganize under Chapter 11. The result was Subchapter V, a specialized type of Chapter 11 that has reshaped business bankruptcy practice across the country. Now, several years later, emerging Florida trends and evolving Subchapter V case law are shaping how courts, creditors, and small business owners use this t

Melissa A. Youngman

Nov 12, 20254 min read

Economic Shocks, COVID Aftermath, and Business Bankruptcy Filings

The COVID 19 pandemic left a deep and lasting imprint on Florida businesses. From hospitality to retail, many companies faced sudden drops in revenue, supply chain disruptions, and shifting consumer behavior. Even though the immediate crisis is in the past, the Florida economic impact of the pandemic continues to shape how business owners manage debt, staffing, and operations.

Melissa A. Youngman

Nov 11, 20254 min read

The Role of the Subchapter V Trustee

Understanding the Subchapter V trustee role in Florida is essential for any business owner considering Chapter 11 under Subchapter V.

Melissa A. Youngman

Nov 10, 20254 min read

Equipment Loans, Leases, and Insolvency: What Florida Small Businesses Need to Know

For many Florida small businesses, equipment is the backbone of daily operations. Whether it’s restaurant ovens, manufacturing machinery, medical devices, or construction vehicles, these assets make running your business possible. The good news: if your business is struggling, Chapter 11, and especially Subchapter V for small to medium sized businesses, can offer a structured, legal path to reorganize equipment debt and keep your operations running.

Melissa A. Youngman

Nov 7, 20254 min read

Merchant Cash Advances and Bankruptcy: What Florida Business Owners Need to Know

For many small business owners, merchant cash advances (MCAs) promise fast, flexible funding when traditional loans aren’t available. But what begins as much needed short term relief often turns into long-term financial distress. MCAs can trap business owners in a cycle of debt that becomes nearly impossible to escape. When that happens, bankruptcy, particularly under Subchapter V, can provide a structured path toward recovery and protection from the predatory lending practic

Melissa A. Youngman

Nov 6, 20254 min read

Struggling Franchisees and Bankruptcy: What Florida Business Owners Need to Know

For franchise owners in financial distress, Chapter 11 bankruptcy or its streamlined alternative, Subchapter V, can provide a way to reorganize debt, keep the doors open, and preserve the value of their business.

Melissa A. Youngman

Nov 5, 20253 min read

Restaurants, Retailers, and Service Businesses: Using Subchapter V to Reorganize

For Florida businesses facing mounting debt, Subchapter V of Chapter 11 offers a streamlined and affordable path to reorganization, one that’s helping many owners keep their doors open and rebuild stronger than before. Here’s how Subchapter V works and why it’s changing the outcome of many restaurant bankruptcy and retail recovery cases across Florida.

Melissa A. Youngman

Nov 4, 20254 min read

Single Asset Real Estate Cases in Chapter 11

When a real estate investment or development project runs into financial trouble, Chapter 11 bankruptcy can provide a powerful tool for restructuring debt and protecting the property. But when that case involves just one piece of real property, such as an apartment complex, hotel, or commercial building, it’s classified as a Single Asset Real Estate (SARE) case by the Bankruptcy Code.

Melissa A. Youngman

Nov 3, 20254 min read

Avoiding Common Pitfalls in Small Business Reorganization

Filing for Chapter 11 or Subchapter V (which is a more streamlined version of Chapter 11 for small to midsize businesses) can be one of the smartest moves a struggling small business makes, but only if it’s done right. While bankruptcy reorganization offers a path to stability and renewal, many business owners run into preventable issues that delay or even derail their case.

Melissa A. Youngman

Nov 1, 20254 min read

Creating a Feasible Reorganization Plan

When a business files under Chapter 11 or Subchapter V, the reorganization plan becomes the heart of the case. It’s more than paperwork — it’s a roadmap for recovery. Courts, creditors, and the U.S. Trustee all judge your case based on whether your reorganization plan is feasible, fair and equitable, and supported by credible financial evidence. In short, this document determines whether your business gets a second chance or faces liquidation.

Melissa A. Youngman

Oct 31, 20253 min read

🏛️ Florida Dynasty Trusts in 2025: How Wealthy Families Keep Wealth Working for Generations

The Quiet Power of a Dynasty Trust For many affluent families in Winter Park, Maitland, and greater Orlando, building wealth has been the easy part, preserving it for future generations is the real challenge. A Florida dynasty trust offers one of the most powerful tools to do just that: a legal structure designed to keep wealth working long after you’re gone. Unlike traditional trusts that expire after a set number of years, Florida law allows certain trusts to continue for

Melissa A. Youngman

Oct 30, 20253 min read

The Critical First 90 Days in Subchapter V: How to Stay on Track

Unlike a traditional Chapter 11 case, Subchapter V moves on a compressed bankruptcy timeline. Within three months, debtors must attend an Initial Debtor Interview and Section 341 Meeting of Creditors, prepare and file all required status reports and monthly operating reports, attend the initial status conference and hearings on first day motions, negotiate and propose a viable plan, and cooperate with the Subchapter V Trustee, the U.S. Trustee and creditors, while keeping the

Melissa A. Youngman

Oct 30, 20254 min read

Selecting the Right Chapter 11 Strategy for Your Business

Choosing the right Chapter 11 strategy means understanding your business’s goals, debt situation, and available resources. For companies in Central Florida, including those pursuing Orlando business restructuring, the difference between a successful turnaround and a drawn-out case often comes down to preparation and planning.

Melissa A. Youngman

Oct 29, 20254 min read

bottom of page